Form 2290 Filing Instructions Step-by-Step

E-file your IRS Form 2290 for the 2025-2026 tax year with these easy instructions.

Gather Required Information

- Employer Identification Number (EIN) - Social Security Number cannot be used.

- Vehicle Identification Number (VIN) for each vehicle.

- Taxable gross weight of each vehicle.

- Month the vehicle was first used on public highways.

- Business name, address, and contact information

Complete and E-file Your Return

- Employer Identification Number (EIN) - Social Security Number cannot be used.

- Vehicle Identification Number (VIN) for each vehicle.

- Taxable gross weight of each vehicle.

- Month the vehicle was first used on public highways.

- Business name, address, and contact information

Choose a Payment Option

- Credit or Debit Card: Pay online, by phone, or via mobile device.

- Electronic Funds Withdrawal: Authorize a direct debit during the e-file process.

- Electronic Federal Tax Payment System (EFTPS): Pre-enroll and allow 5-7 business days for enrollment.

Receive Your Stamped 2290 Schedule 1

After the IRS accepts your e-filed Form 2290, your e-file provider will email your watermarked Schedule 1.

Ensure the watermark is legible before submitting it to your state department of motor vehicles

Who should file Form 2290?

Form 2290, also known as the Heavy Highway Vehicle Use Tax Return is filed by a truck owner, fleet owner, tax professional (file Form 2290 on behalf of the vehicle owner or registrant) or an individual who operate can file Form 2290 on behalf of the vehicle owner or registrant.

- The vehicle must be registered (or required to be registered) in the owner’s name.

- The vehicle must have a taxable gross weight of 55,000 pounds or more.

- The vehicle must be used on public highways during the tax period.

E-file 2290 On-the-go with GreenTax2290

Greentax2290 provides the trucking industry with faster, simpler, easier and most cost-effective ways to eFile Form 2290.

Get Stamped Schedule 1 Instantly

Instant Error Check

Calculate accurate HVUT taxes

Line-by-line Detailed 2290 Filing Instructions- How to fill out 2290 form?

Here are the line-by-line 2290 instructions to fill out HVUT:

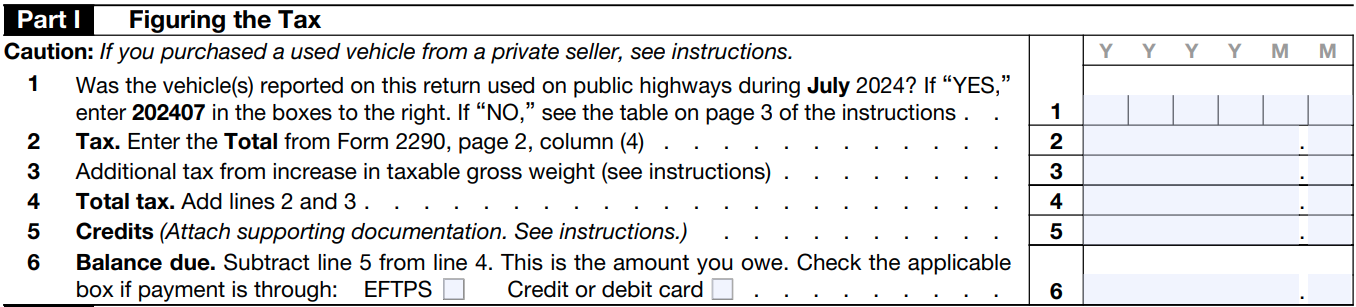

Part 1: Figuring the Tax

Line 1: Enter the date for the month of first vehicle use during the tax period.

Line 2: To calculate the tax amount on line 2, fill out the Tax Computation table found on page 2. Then, enter that total in line 2.

Note: Avoid using line 2 to report additional tax from an increase in taxable gross weight.

Line 3: Report the additional tax due to an increase in the vehicle’s taxable gross weight. Complete this line only if the taxable gross weight of a vehicle increases during the period and the vehicle falls into a new category.

Line 4: Add lines 2 and 3 and enter the total tax amount.

Line 5: Complete this line only if you are claiming a credit for tax paid on a vehicle that was:

- Sold before June 1 and not used during the remainder of the period,

- Destroyed (so damaged by an accident or other casualty it isn't economical to rebuild it) or stolen before June 1 and not used during the remainder of the period, or Used during the prior period 5,000 miles or less (7,500 miles or less for agricultural vehicles)

- Address Change - If your address has changed, check the Address Change box.

- Note: The amount claimed on line 5 cannot exceed the tax reported on line 4 in Part 1.

Line 6: To calculate the amount for line 6, subtract line 5 from line 4. This is the tax amount you owe.

Check the respective box on how you're going to make the payment; either via EFTPS or Credit/Debit card.

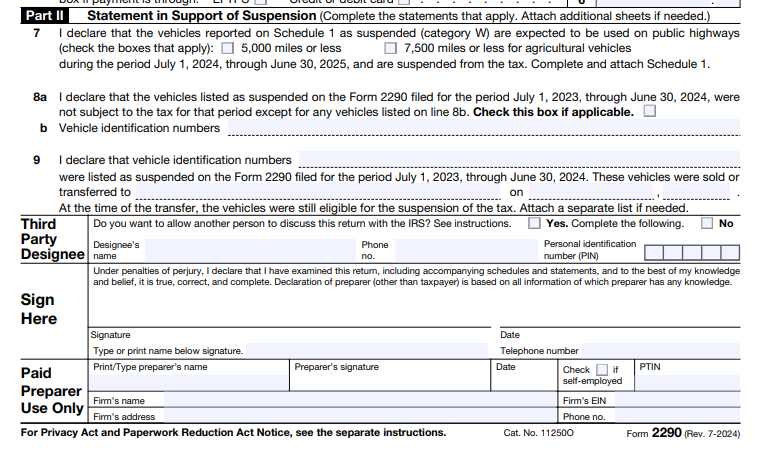

Part II. Statement in Support of Suspension

In this part, complete the line that’s applicable to you.

Line 7: Enter the total number of vehicles for which you are suspending the tax. Here, the vehicles that are expected to be suspended should be used less than the mileage use limit during the period (i.e. 5,000 miles or less for commercial vehicles and 7,500 miles or less for agricultural vehicles).

Line 8a: Verify in this line that vehicles listed as suspended on Form 2290 for the prior tax period were not subject to the tax for that period.

Line 8b: If you check box 8a, you must enter the VINs of the vehicles listed as suspended in the prior period and then used for 5,000 miles or more during the period (7,500 miles or more for agricultural vehicles).

Line 9: Provide the number of vehicles that were sold, destroyed, transferred, or used 5,000 miles or less during the prior tax period.

Line 10: If you are claiming a refund for vehicles that were sold, destroyed, or used 5,000 miles or less (7,500 miles or less for agricultural vehicles) during the prior tax period, enter the number of such vehicles in this line.

Additional Information

Third Party Designee

If you want to allow an employee of your business, a return preparer, or other third parties to discuss your Form 2290 with the IRS, check the Yes box in the Third Party Designee section of Form 2290.

Also, enter the designee's name, phone number, and any five digits that the person chooses as their personal identification number (PIN). The authorization applies only to the tax return on which it appears.

Signature

After you verify all the information in the return, sign it along with the date and telephone number. Returns filed without a signature will be sent back to you for signing.

Paid Preparer Use Only

This section must be completed by your Paid Preparer only. The preparer must give you a copy of the form in addition to the copy to be transmitted to the IRS.